Insurance for Commuting: Protecting Your Daily Journey

Commuting to work or school is a routine part of life for many people. Whether you travel by train, bus, car, or bike, the daily journey can come with its own set of risks. That’s where insurance for commuting comes in.

Having the right insurance coverage can provide you with peace of mind knowing that you’re protected in case of unexpected events during your daily commute. From accidents and injuries to theft and damage to personal belongings, commuting insurance can help mitigate the financial impact of these incidents.

For those who rely on public transportation, such as trains or buses, commuter insurance can offer coverage for delays and cancellations, ensuring that you’re not left out of pocket when your journey doesn’t go as planned.

If you drive to work, having car insurance is essential not only for legal reasons but also to protect yourself and others on the road. Comprehensive coverage can safeguard you against accidents, theft, vandalism, and other unforeseen circumstances that may arise during your commute.

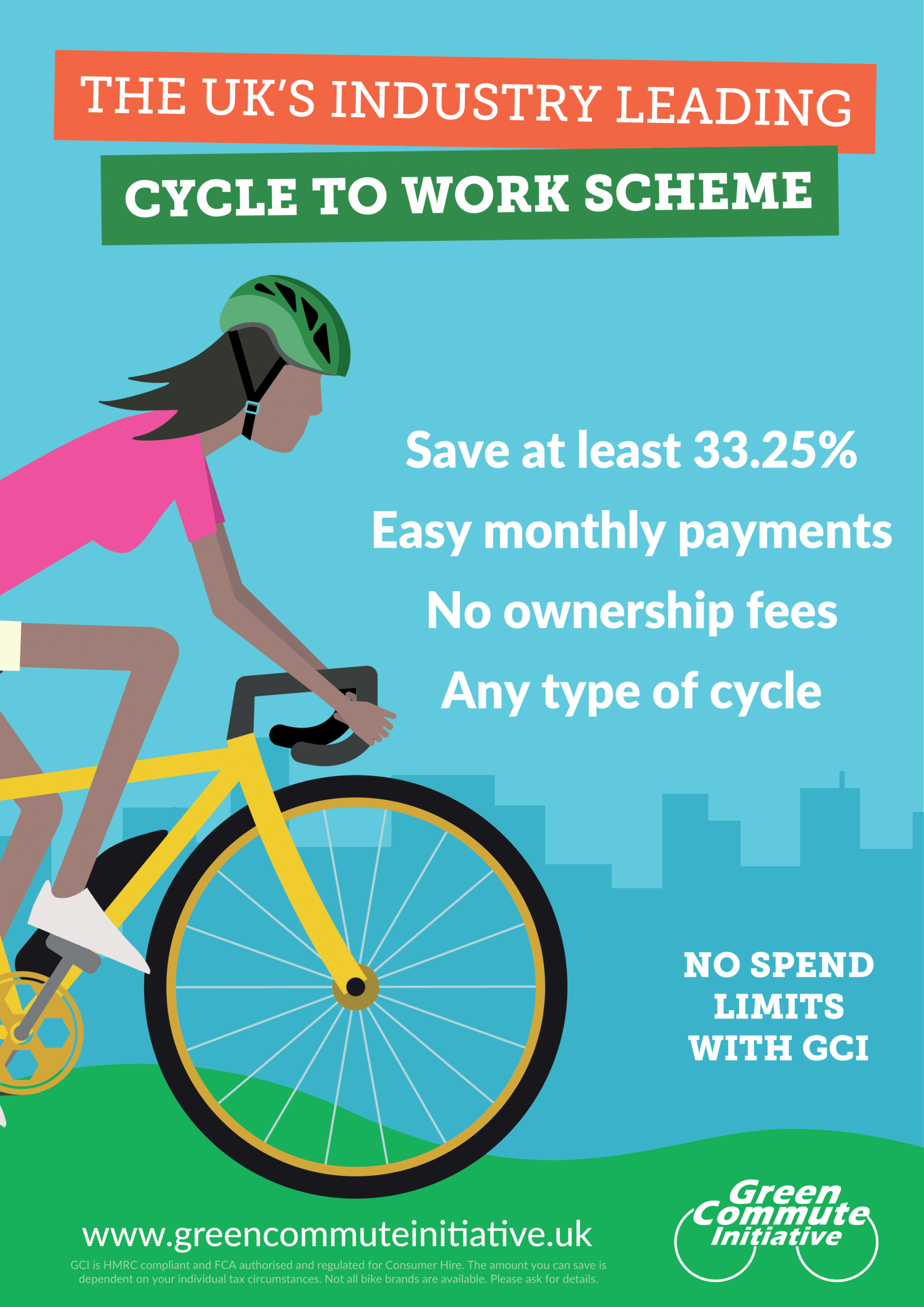

Cyclists can also benefit from insurance tailored specifically for bike commuters. This type of coverage typically includes protection against theft, damage to your bike, and liability in case of accidents involving other road users.

When considering insurance for commuting, it’s important to assess your individual needs and choose a policy that provides adequate protection based on your mode of transportation and specific risks you may encounter during your daily journey.

Ultimately, investing in insurance for commuting is a proactive way to safeguard yourself against the uncertainties that come with travelling regularly. By choosing the right coverage, you can ensure that your daily commute remains a safe and secure experience.

Understanding Commuting and Its Impact on Car Insurance: Key Questions Answered

- Do I need to add commuting to my car insurance?

- Is insurance more expensive if you commute?

- Does driving to school count as commuting?

- What does commuting mean on insurance?

Do I need to add commuting to my car insurance?

When considering whether to add commuting to your car insurance policy, it’s essential to understand the implications of your daily journey on your coverage. Commuting typically involves using your vehicle for travel to and from work or school, which may affect the level of risk associated with your driving habits. By including commuting in your car insurance, you ensure that you are adequately covered for any incidents that may occur during these regular trips. It’s important to review your policy carefully and consult with your insurance provider to determine the best course of action based on your specific commuting needs and circumstances.

Is insurance more expensive if you commute?

When it comes to insurance for commuting, the cost can vary depending on several factors. Insurance providers may take into account the distance of your commute, the frequency of your travels, and the mode of transportation you use. Generally, if you have a long daily commute or if you drive a significant distance to work, you may see a slight increase in your insurance premium to reflect the higher risk associated with more time spent on the road. However, it’s essential to shop around and compare quotes from different insurers to find a policy that offers adequate coverage at a competitive price for your commuting needs.

Does driving to school count as commuting?

When it comes to insurance, the classification of driving to school as commuting can vary depending on the insurance provider and policy terms. In general, if the primary purpose of driving to school is for educational or academic reasons, it may be considered a form of commuting. However, it’s essential to review your specific insurance policy to determine how your insurer defines commuting and whether driving to school falls under this category. Clarifying this with your insurance provider can help ensure that you have the appropriate coverage for your daily journey to school.

What does commuting mean on insurance?

In the context of insurance, commuting refers to the regular travel that an individual undertakes between their home and their place of work or study. Insurance policies often distinguish between commuting and other types of travel, such as leisure trips or business travel, as the frequency and purpose of commuting can impact the level of risk associated with the journey. Understanding what commuting means on insurance is essential for ensuring that you have the appropriate coverage in place to protect yourself during your daily travels to and from your regular destination.