Understanding Insurance Prices: What You Need to Know

Insurance prices can vary significantly depending on a range of factors. From your age and location to the type of coverage you need, there are many elements that insurers take into account when determining the cost of your policy.

Factors Influencing Insurance Prices

One of the key factors that can impact insurance prices is your personal details, such as your age, occupation, and driving record. Younger drivers, for example, often face higher premiums due to their lack of experience on the road.

Additionally, the level of coverage you choose will also affect the price you pay. Comprehensive policies that offer extensive protection will generally be more expensive than basic plans with limited coverage.

Ways to Lower Insurance Costs

While insurance prices can seem daunting, there are steps you can take to lower your premiums. One common way is to increase your excess – the amount you agree to pay towards a claim – which can reduce your monthly payments.

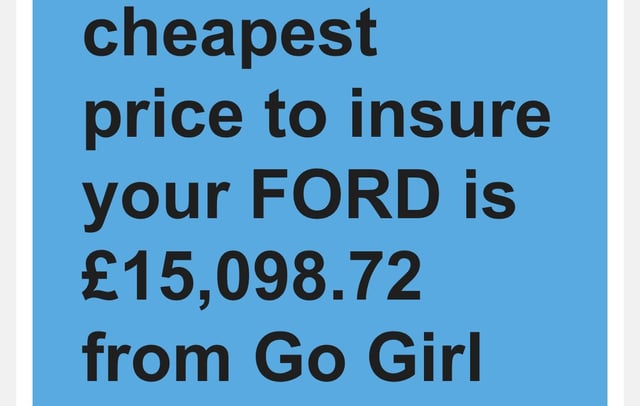

Another effective method is to shop around and compare quotes from different insurers. By exploring multiple options, you can find a policy that offers the right balance between coverage and affordability.

The Importance of Finding the Right Policy

When it comes to insurance prices, it’s essential to strike a balance between cost and coverage. While opting for the cheapest policy may save you money upfront, it could leave you vulnerable in the event of a claim.

By understanding the factors that influence insurance prices and exploring ways to lower costs without compromising on protection, you can make informed decisions when selecting an insurance policy that meets your needs and budget.

Understanding Car Insurance Costs: Key Questions Answered

- How much is average car insurance per car?

- Why has car insurance doubled?

- How much is insurance for a 25 year old in the UK?

- Who does insurance pricing?

- Who typically has the cheapest car insurance?

How much is average car insurance per car?

The average cost of car insurance per car can vary depending on various factors such as the driver’s age, driving history, type of vehicle, and location. On average, car insurance in the UK can range from around £500 to £1,000 per year for a standard policy. However, it’s important to note that this is just an estimate, and individual quotes may differ significantly based on personal circumstances. To get an accurate idea of how much car insurance will cost for a specific vehicle, it’s recommended to obtain quotes from different insurers and compare coverage options tailored to your needs.

Why has car insurance doubled?

Car insurance doubling can be attributed to various factors that impact insurance prices. Changes in personal circumstances, such as moving to a high-risk area or getting involved in accidents, can lead to premium increases. Additionally, industry-wide trends, such as rising repair costs or an increase in fraudulent claims, can also contribute to higher insurance rates. It’s essential for policyholders to regularly review their coverage and shop around for competitive quotes to ensure they are getting the best value for their money amidst fluctuating insurance prices.

How much is insurance for a 25 year old in the UK?

When determining the cost of insurance for a 25-year-old in the UK, several factors come into play. Typically, insurance premiums for younger drivers tend to be higher due to their perceived higher risk on the road. Factors such as driving experience, type of vehicle, location, and claims history can all influence the final price. It’s important for 25-year-olds to compare quotes from different insurers to find a policy that offers a balance between affordability and adequate coverage tailored to their individual circumstances.

Who does insurance pricing?

Insurance pricing is determined by actuaries who work for insurance companies. Actuaries use complex mathematical models and statistical analysis to assess risk and calculate the likelihood of claims being made. They take into account various factors such as age, location, driving record, and the type of coverage needed to determine the price of an insurance policy. Actuaries play a crucial role in setting fair and competitive prices that reflect the level of risk associated with insuring an individual or property.

Who typically has the cheapest car insurance?

When it comes to car insurance prices, various factors come into play in determining who typically has the cheapest premiums. Generally, individuals with a clean driving record, older drivers with years of experience, and those living in low-risk areas tend to secure lower insurance rates. Additionally, drivers who opt for vehicles with high safety ratings and lower theft risk may also benefit from more affordable car insurance. However, it’s essential to note that each insurance provider assesses risk differently, so it’s advisable for individuals to compare quotes from multiple insurers to find the best deal tailored to their specific circumstances.