The Importance of Understanding Your Insurance Contract

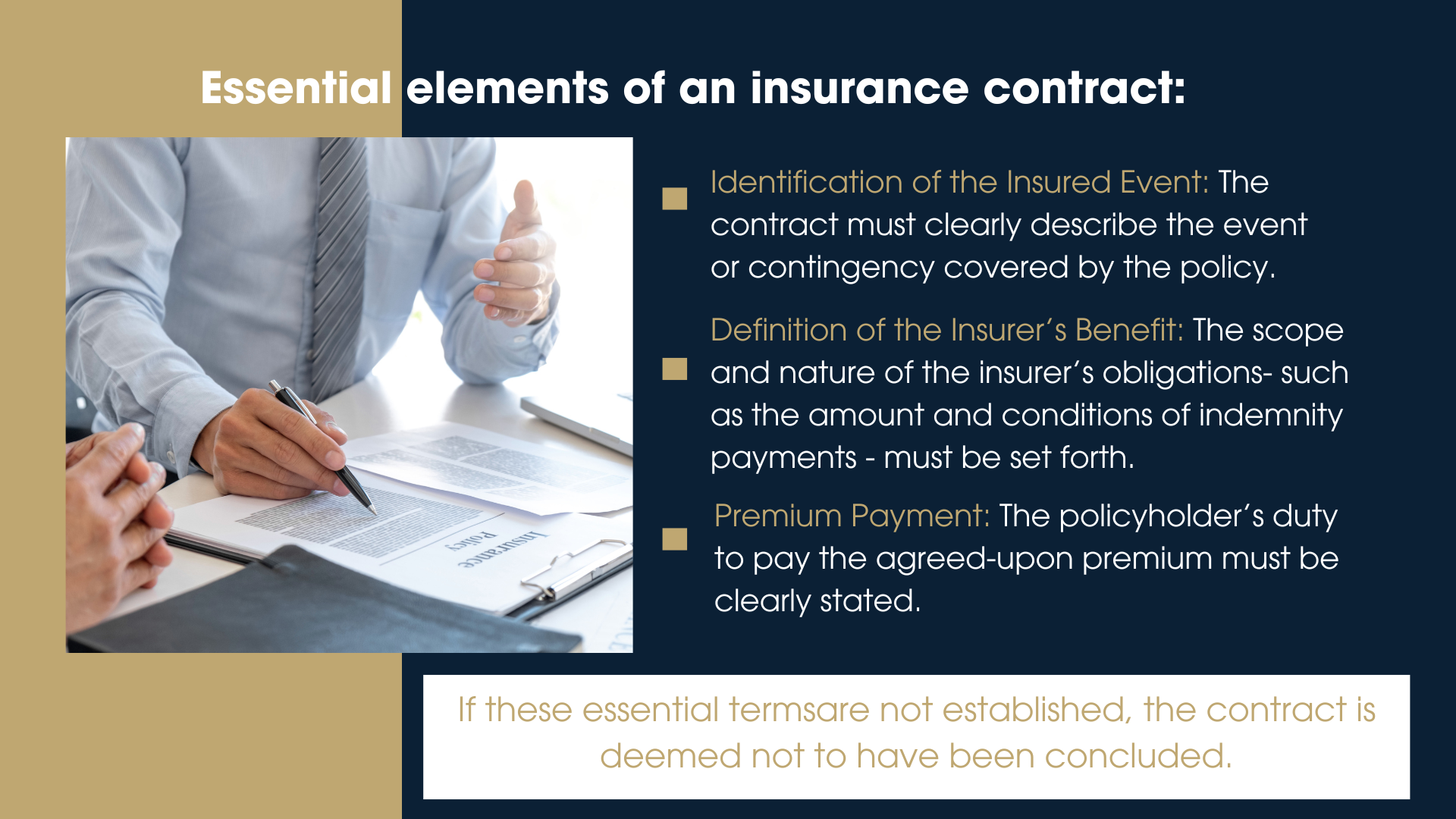

Insurance contracts are legal agreements between an insurance company and a policyholder. These contracts outline the terms and conditions of the insurance coverage, including what is covered, what is excluded, how claims are handled, and the responsibilities of both parties.

It is crucial for policyholders to thoroughly read and understand their insurance contracts to ensure they have the right coverage for their needs. Here are some key points to consider:

Coverage Details

Insurance contracts specify what risks are covered by the policy. It is important to know exactly what is included in your coverage to avoid any surprises when filing a claim.

Exclusions

Insurance policies also list exclusions – situations or events that are not covered by the insurance. Understanding these exclusions can help you assess your potential risks and take additional precautions if needed.

Premiums and Deductibles

The contract will detail how much you need to pay for your insurance coverage, including premiums (regular payments) and deductibles (the amount you must pay out of pocket before the insurance kicks in).

Claim Procedures

Knowing how to file a claim and what documentation is required can help streamline the claims process in case of an incident. Familiarise yourself with the procedures outlined in your contract.

Renewal Terms

Insurance contracts also specify how long the coverage lasts and under what conditions it can be renewed. Be aware of renewal terms to avoid any lapses in coverage.

In conclusion, understanding your insurance contract is essential for making informed decisions about your coverage. If you have any questions or concerns about your policy, don’t hesitate to reach out to your insurance provider for clarification.

Five Key Benefits of Insurance Contracts: Financial Protection, Peace of Mind, Risk Distribution, Customised Coverage, and Legal Compliance

- Provides financial protection against unexpected events or losses.

- Offers peace of mind knowing that you are covered in case of emergencies.

- Helps spread the risk among policyholders, reducing individual financial burden.

- Can cover a wide range of risks and liabilities, tailored to your specific needs.

- Ensures legal compliance and financial security for individuals and businesses.

Understanding the Drawbacks of Insurance Contracts: Navigating Complex Language, Exclusions, Rising Premiums, and Claim Denials

Provides financial protection against unexpected events or losses.

An insurance contract offers valuable financial protection by safeguarding individuals and businesses against unforeseen events or losses. By having the right insurance coverage in place, policyholders can mitigate the financial impact of unexpected circumstances such as accidents, natural disasters, or theft. This proactive approach to risk management provides peace of mind and ensures that individuals and businesses can recover and rebuild without facing significant financial strain.

Offers peace of mind knowing that you are covered in case of emergencies.

One significant advantage of having an insurance contract is the peace of mind it provides by assuring you that you are protected in the event of emergencies. Knowing that you have coverage in place can alleviate worries about unexpected expenses or losses, allowing you to focus on navigating challenging situations with confidence and security. This sense of reassurance that comes from being prepared for unforeseen circumstances is a valuable benefit of having an insurance contract in place.

Helps spread the risk among policyholders, reducing individual financial burden.

One significant advantage of insurance contracts is their ability to distribute risk among policyholders, thus lessening the financial burden on any single individual. By pooling resources through premiums paid by a group of policyholders, the risk of facing a substantial financial loss due to unforeseen events is shared collectively. This system provides a sense of security and stability to individuals, ensuring that the impact of unexpected circumstances is mitigated through the support of the insurance network.

Can cover a wide range of risks and liabilities, tailored to your specific needs.

One significant advantage of insurance contracts is their ability to cover a diverse array of risks and liabilities, all customised to meet your individual requirements. Whether you’re seeking protection for your home, car, health, or business, insurance contracts can be tailored to provide the specific coverage you need. This flexibility ensures that you have peace of mind knowing that you are adequately protected against a wide range of potential risks and uncertainties that may arise in your personal or professional life.

Ensures legal compliance and financial security for individuals and businesses.

An insurance contract plays a crucial role in ensuring legal compliance and financial security for both individuals and businesses. By entering into a formal agreement with an insurance provider, policyholders can rest assured that they are meeting any legal requirements for coverage while also safeguarding their financial well-being in the event of unexpected risks or losses. This proactive approach not only helps individuals and businesses fulfil their obligations but also provides a safety net that can mitigate potential financial hardships, offering peace of mind and stability in uncertain times.

Complex Legal Language

One significant drawback of insurance contracts is the presence of complex legal language that can often be overwhelming and confusing for the average person. The use of intricate terminology and legal jargon in these contracts can make it challenging for policyholders to fully grasp the terms and conditions of their coverage. This lack of clarity may lead to misunderstandings or misinterpretations, potentially resulting in inadequate coverage or unexpected issues when filing a claim. It is essential for insurance companies to strive for greater transparency and simplicity in their contract language to ensure that policyholders can easily comprehend their rights, obligations, and the extent of their insurance coverage.

Exclusions and Limitations

Exclusions and limitations within insurance contracts can present a significant drawback, as they may result in policyholders being left vulnerable and uncovered in specific scenarios. These restrictions outline circumstances or events that are not covered by the insurance policy, potentially leading to unexpected gaps in coverage when filing a claim. It is essential for individuals to carefully review and understand these exclusions and limitations to assess their level of risk exposure accurately and consider additional coverage options if necessary. Failure to recognise and address these exclusions could leave policyholders facing financial burdens or setbacks at the time of need.

Premium Increases

One significant drawback of insurance contracts is the potential for premium increases. Insurers have the authority to adjust premiums over time, which can result in insurance becoming more costly than originally expected. This con can catch policyholders off guard and strain their finances, especially if the increase is substantial. It is essential for individuals to be aware of this possibility when entering into an insurance contract and to consider the potential impact of premium hikes on their budget in the long run.

Claim Denials

One significant drawback of insurance contracts is the potential for claim denials. If a claim fails to meet all the specific requirements detailed in the contract, there is a risk that the insurance company may deny it. This can be frustrating and stressful for policyholders who were counting on their insurance coverage to provide financial protection in times of need. It underscores the importance of thoroughly understanding the terms and conditions of your insurance contract to ensure that you meet all obligations and requirements to avoid potential claim denials.