The Importance of Cancellation Insurance for Travel

When planning a trip, one of the last things on your mind is likely the possibility of having to cancel it. However, unforeseen circumstances can arise at any time, leading to the need to change your travel plans. This is where cancellation insurance comes into play.

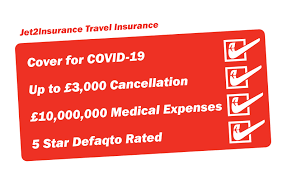

Cancellation insurance provides you with financial protection in case you need to cancel your trip due to reasons such as illness, injury, or unexpected events like natural disasters or job loss. Without this coverage, you could be left with hefty cancellation fees and losses.

Having cancellation insurance not only gives you peace of mind but also allows you to recoup some or all of the costs associated with cancelling your trip. This can include expenses such as flights, accommodation, tours, and other pre-paid arrangements.

It’s essential to carefully review the terms and conditions of your cancellation insurance policy to understand what is covered and any exclusions that may apply. Some policies may have specific requirements for cancellations, such as providing medical documentation or proof of the unforeseen event.

When considering purchasing cancellation insurance, think about factors that could potentially disrupt your travel plans and assess whether the coverage provided aligns with your needs. While it may seem like an additional expense upfront, having cancellation insurance can save you from significant financial loss in the long run.

Remember that prevention is always better than cure when it comes to travel disruptions. By investing in cancellation insurance, you can travel with confidence knowing that you have a safety net in place should the unexpected occur.

Five Essential Tips for Navigating Cancellation Insurance for Your Travels

- Read the policy details carefully to understand what is covered and under what circumstances you can cancel.

- Consider purchasing cancellation insurance at the time of booking your trip to ensure coverage from the start.

- Be aware of any exclusions or limitations in the policy, such as pre-existing medical conditions or specific cancellation reasons.

- Keep documentation of your trip and any expenses incurred in case you need to make a claim later on.

- Contact your insurance provider as soon as possible if you need to cancel your trip, and follow their instructions for making a claim.

Read the policy details carefully to understand what is covered and under what circumstances you can cancel.

It is crucial to carefully review the policy details of your cancellation insurance to have a clear understanding of what is covered and the specific circumstances under which you can cancel your trip. By familiarising yourself with the terms and conditions outlined in the policy, you can ensure that you are fully aware of your rights and obligations in case you need to make a cancellation. This proactive approach not only helps you make informed decisions but also gives you peace of mind knowing that you are well-prepared for any unforeseen events that may arise during your travels.

Consider purchasing cancellation insurance at the time of booking your trip to ensure coverage from the start.

When booking your trip, it is advisable to consider purchasing cancellation insurance right from the start. By securing this coverage at the time of booking, you can ensure that you are protected from unforeseen circumstances that may arise before your trip commences. This proactive approach not only provides you with immediate coverage but also offers peace of mind knowing that you are financially safeguarded right from the beginning of your travel planning process.

Be aware of any exclusions or limitations in the policy, such as pre-existing medical conditions or specific cancellation reasons.

When considering cancellation insurance, it is crucial to be mindful of any exclusions or limitations outlined in the policy. Factors such as pre-existing medical conditions or specific reasons for cancellation may not be covered under the insurance plan. Understanding these exclusions beforehand can help you make an informed decision and avoid any surprises when it comes to filing a claim. Take the time to review the policy details carefully to ensure that you have a clear understanding of what is and isn’t covered, allowing you to choose a policy that best suits your needs and provides comprehensive protection for unforeseen circumstances.

Keep documentation of your trip and any expenses incurred in case you need to make a claim later on.

It is crucial to keep thorough documentation of your trip and any expenses you incur, especially if you anticipate needing to make a claim on your cancellation insurance later on. This documentation can include receipts, booking confirmations, medical certificates, and any other relevant paperwork that supports your claim. By maintaining organized records of your trip details and expenses, you can streamline the claims process and ensure that you have the necessary evidence to support your case in the event of unforeseen cancellations or disruptions.

Contact your insurance provider as soon as possible if you need to cancel your trip, and follow their instructions for making a claim.

In the event that you need to cancel your trip, it is crucial to contact your insurance provider as soon as possible and adhere to their guidance on initiating a claim. By promptly notifying your insurer and following their specified procedures, you can expedite the claims process and ensure that you meet all necessary requirements for potential reimbursement. This proactive approach not only demonstrates your commitment to resolving the situation efficiently but also maximises the chances of a successful claim outcome.