The Importance of an Audit Department in Business Operations

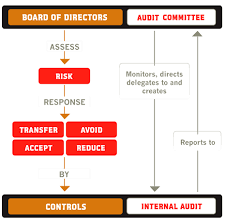

In any organisation, the audit department plays a crucial role in ensuring transparency, accountability, and compliance with regulations. This department is responsible for reviewing financial records, internal controls, and operational processes to identify potential risks and areas for improvement.

One of the primary functions of the audit department is to conduct regular audits of financial statements to verify their accuracy and reliability. By examining income, expenses, assets, and liabilities, auditors can provide assurance to stakeholders that the company’s financial position is accurately represented.

Furthermore, the audit department helps in safeguarding assets by assessing internal controls and identifying weaknesses that could lead to fraud or mismanagement. By implementing recommendations from audit findings, organisations can strengthen their control environment and prevent potential losses.

Audit departments also play a vital role in ensuring compliance with laws and regulations governing financial reporting. By staying abreast of changing regulatory requirements and industry standards, auditors help companies avoid penalties and reputational damage resulting from non-compliance.

Moreover, the audit department serves as an independent body within the organisation that provides objective assessments of operations. This independence allows auditors to offer unbiased insights into areas needing improvement and facilitate decision-making at all levels of management.

In conclusion, the audit department is an essential component of effective corporate governance. By promoting transparency, accountability, and adherence to best practices, this department contributes to the overall success and sustainability of businesses in today’s complex operating environment.

Five Essential Strategies for Enhancing Your Audit Department’s Effectiveness

- Ensure compliance with relevant laws and regulations.

- Maintain accurate and detailed financial records.

- Regularly review internal controls to prevent fraud or errors.

- Perform thorough and independent audits of financial statements.

- Communicate findings effectively to management for corrective action.

Ensure compliance with relevant laws and regulations.

It is imperative for the audit department to prioritise ensuring compliance with relevant laws and regulations. By staying updated on legal requirements and industry standards, auditors can help the organisation avoid potential penalties, litigation, and reputational damage. Compliance not only safeguards the company’s interests but also builds trust with stakeholders by demonstrating a commitment to ethical business practices. Maintaining a strong focus on adherence to regulations is key to upholding the integrity and credibility of the audit process and the organisation as a whole.

Maintain accurate and detailed financial records.

To ensure the effectiveness of an audit department, it is imperative to maintain accurate and detailed financial records. By keeping meticulous records of income, expenses, assets, and liabilities, organisations provide auditors with the necessary information to conduct thorough assessments of their financial health. Accurate financial records not only facilitate the auditing process but also help in identifying potential discrepancies, errors, or fraudulent activities. Additionally, maintaining detailed financial records enables companies to demonstrate transparency and compliance with regulatory requirements, enhancing trust and confidence among stakeholders. Overall, the practice of maintaining accurate and detailed financial records is essential for a robust audit function that upholds integrity and accountability within an organisation.

Regularly review internal controls to prevent fraud or errors.

Regularly reviewing internal controls is a crucial tip for any audit department to prevent fraud or errors within an organisation. By conducting frequent assessments of internal control mechanisms, auditors can identify weaknesses or gaps that may leave the company vulnerable to fraudulent activities or inaccuracies in financial reporting. Proactive monitoring and strengthening of internal controls not only deter potential misconduct but also enhance the overall integrity and reliability of the organisation’s operations. This preventive approach helps mitigate risks and ensures that the company maintains a robust control environment that safeguards its assets and promotes trust among stakeholders.

Perform thorough and independent audits of financial statements.

To ensure the integrity and accuracy of financial reporting, it is imperative for the audit department to conduct comprehensive and independent audits of financial statements. By scrutinising income, expenses, assets, and liabilities with meticulous attention to detail, auditors can provide stakeholders with assurance regarding the reliability of the company’s financial position. Performing thorough audits not only helps in detecting errors or discrepancies but also enhances transparency and accountability within the organisation. Independent audits conducted by the audit department serve as a critical tool in maintaining trust and credibility with investors, regulators, and other key stakeholders.

Communicate findings effectively to management for corrective action.

Effective communication of audit findings to management is essential for driving corrective action and improving organisational processes. By clearly articulating the results of audits, including identified risks, control weaknesses, and areas for improvement, the audit department enables management to make informed decisions that enhance operational efficiency and mitigate potential threats. Timely and concise reporting of findings ensures that necessary corrective measures are promptly implemented, leading to a more robust control environment and better risk management practices within the organisation. Clear communication channels between the audit department and management facilitate a collaborative approach to addressing issues and fostering continuous improvement across all levels of the company.