UK Train Insurance Comparison: Finding the Right Coverage for Your Railway Journeys

Travelling by train is a popular and convenient way to get around the UK. Whether you’re a daily commuter or an occasional traveller, having the right insurance coverage for your train journeys is essential. With numerous insurance providers offering different policies, it can be overwhelming to find the one that suits your needs. That’s where UK train insurance comparison comes in.

Comparing train insurance policies allows you to evaluate different options and make an informed decision. It helps you understand the coverage, benefits, and costs associated with each policy, ensuring that you select the one that best meets your requirements.

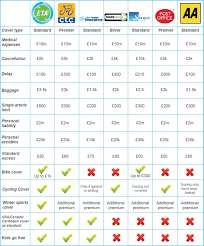

One of the key advantages of using a train insurance comparison service is that it saves you time and effort. Instead of individually researching multiple insurers and their policies, a comparison platform brings all the information together in one place. You can easily compare features like coverage limits, excess amounts, claim processes, and additional benefits side by side.

When comparing UK train insurance policies, there are several factors to consider:

- Coverage Options: Look for policies that provide comprehensive coverage for incidents such as theft or loss of personal belongings during your journey, accidents or injuries on trains or at stations, trip cancellations or delays due to unforeseen circumstances, and more.

- Excess Amount: Excess is the amount you must pay towards a claim before your insurer covers the remaining cost. Compare excess amounts across different policies to find one that aligns with your budget.

- Additional Benefits: Some insurers offer additional benefits like legal assistance in case of personal injury claims or access to emergency helplines while travelling. Assess these extras to determine their value for your specific needs.

- Price: While price shouldn’t be the sole deciding factor, it’s important to compare premiums across different insurers to ensure you’re getting a competitive rate for the coverage provided.

- Customer Reviews: Consider reading customer reviews and ratings to gauge the experiences of others who have used the insurance policies you are considering. This can provide valuable insights into the quality of service and claims handling.

By comparing UK train insurance policies, you can find the right coverage that suits your budget and offers peace of mind during your railway journeys. It’s important to remember that everyone’s needs are different, so what works for one person may not work for another. Take the time to assess your specific requirements and priorities before making a decision.

At TrainSureQuotes.co.uk, we understand the importance of finding the right insurance coverage for train travellers in the UK. Our platform allows you to compare multiple insurers and their policies, ensuring that you make an informed choice that best protects you during your railway adventures.

Don’t leave your train journeys unprotected. Start comparing UK train insurance policies today and travel with confidence knowing that you’re covered every step of the way.

5 Essential Tips for Comparing UK Train Insurance Policies

- Shop around and compare different policies to find the one that best suits your needs.

- Make sure you read all the terms and conditions of any policy before making a purchase.

- Check for any excess charges or hidden costs associated with each policy you are considering.

- Consider taking out an annual policy if you travel regularly by train, as this could save you money in the long run.

- If possible, use a comparison website to ensure you get the best deal on your insurance policy.

Shop around and compare different policies to find the one that best suits your needs.

Shop Around and Compare: Finding the Perfect UK Train Insurance Policy

When it comes to UK train insurance, one size does not fit all. Every traveller has unique needs and preferences, which is why it’s crucial to shop around and compare different policies before making a decision. By taking the time to explore your options, you can find the coverage that best suits your requirements.

Shopping around for train insurance allows you to assess various policies offered by different insurers. Each policy comes with its own set of features, benefits, and costs. By comparing them side by side, you can identify the one that aligns perfectly with your needs.

Start by considering what aspects of train travel are most important to you. Are you concerned about protecting your personal belongings? Do you want coverage in case of accidents or injuries during your journey? Or perhaps you’re looking for protection against trip cancellations or delays? Knowing what matters most will help you narrow down your search.

Next, compare the coverage options provided by different insurers. Look at the limits and exclusions of each policy to ensure they meet your specific requirements. Some policies may offer additional benefits such as legal assistance or emergency helplines – consider whether these extras are valuable to you.

Price is another crucial factor when comparing policies. While it shouldn’t be the sole determining factor, it’s important to find a policy that fits within your budget. Consider the premium costs as well as any excess amounts that may apply in case of a claim.

Don’t forget to read customer reviews and ratings for each insurer and policy you’re considering. Learning from others’ experiences can provide valuable insights into the quality of service and claims handling.

Shopping around for UK train insurance doesn’t have to be a daunting task. With online comparison platforms like TrainSureQuotes.co.uk, finding the perfect policy becomes easier than ever before. These platforms bring together multiple insurers and their policies in one place, allowing you to compare them effortlessly.

Remember, your train journeys deserve the right protection. By shopping around and comparing different policies, you can find the one that best suits your needs, giving you peace of mind during every adventure on the rails.

So, don’t settle for the first policy you come across. Take the time to explore your options and make an informed decision. Start comparing UK train insurance policies today and embark on your railway travels with confidence, knowing that you’re covered every step of the way.

Make sure you read all the terms and conditions of any policy before making a purchase.

UK Train Insurance Comparison: The Importance of Reading Terms and Conditions

When it comes to purchasing train insurance in the UK, one crucial tip stands out above the rest: always read the terms and conditions before making a purchase. While it may seem tempting to quickly skim through or skip over this section, taking the time to understand the fine print can save you from potential headaches down the line.

The terms and conditions of an insurance policy outline important details about coverage, limitations, exclusions, and claim procedures. By carefully reviewing these terms, you gain a clear understanding of what is covered by your policy and what is not. This knowledge allows you to make an informed decision about whether the policy meets your specific needs.

Here are a few key reasons why reading the terms and conditions is essential when comparing UK train insurance policies:

- Coverage Details: The terms and conditions will outline exactly what incidents are covered by your policy. This includes scenarios such as theft or loss of personal belongings, accidents or injuries on trains or at stations, trip cancellations or delays, and more. Understanding these coverage details ensures that you have adequate protection for your specific requirements.

- Limitations and Exclusions: Insurance policies often come with certain limitations and exclusions that may affect your coverage. For example, there may be restrictions on high-value items or specific circumstances under which claims will not be accepted. Being aware of these limitations helps manage expectations and avoids surprises when filing a claim.

- Claim Procedures: The terms and conditions provide important information about how to file a claim in case of an incident. It outlines the necessary steps, documentation requirements, time limits, and contact details for making a claim. Familiarizing yourself with these procedures ensures that you are prepared should you need to make a claim in the future.

- Policy Duration and Renewal: Understanding the duration of your policy is essential for planning purposes. Additionally, reviewing renewal terms can help avoid any unexpected changes or premium increases when it’s time to renew your coverage.

Remember, the terms and conditions are a legally binding agreement between you and the insurance provider. By reading and understanding them, you can make an informed decision and avoid any potential misunderstandings or disputes in the future.

At TrainSureQuotes.co.uk, we emphasize the importance of reading the terms and conditions of any policy before making a purchase. Our platform provides easy access to these documents, allowing you to review them thoroughly alongside other policy details during your UK train insurance comparison.

So, take the time to read and understand the terms and conditions of any insurance policy you consider. It’s a small step that can make a big difference in ensuring that you have the right coverage for your train journeys in the UK.

Check for any excess charges or hidden costs associated with each policy you are considering.

When comparing UK train insurance policies, one crucial tip is to check for any excess charges or hidden costs associated with each policy you are considering. While the premium may seem affordable at first glance, additional charges can quickly add up and impact your overall coverage.

Excess charges refer to the amount you are required to pay towards a claim before your insurance coverage kicks in. It’s essential to understand the excess amount for each policy as it can vary significantly between insurers. Some policies may have a low excess, while others may have a higher one.

By checking the excess charges upfront, you can determine if it aligns with your budget and financial capabilities. A high excess amount might result in out-of-pocket expenses that you hadn’t anticipated in the event of a claim. On the other hand, a lower excess could mean higher premiums.

Hidden costs are another aspect to be cautious of when comparing train insurance policies. Take the time to carefully review the policy documents and terms and conditions to identify any additional fees or charges that may apply. These could include administration fees, cancellation fees, or fees for making changes to your policy.

Being aware of these potential hidden costs allows you to make an informed decision about which policy offers the best value for money. It ensures that you’re not caught off guard by unexpected expenses down the line.

When comparing UK train insurance policies, it’s important to consider both the coverage provided and any associated costs. By checking for excess charges and hidden costs, you can have a clearer understanding of the overall affordability and value of each policy.

At TrainSureQuotes.co.uk, we prioritize transparency in our comparison service. We provide detailed information on excess amounts and any additional fees associated with each policy we showcase. We believe that understanding all aspects of an insurance policy is crucial in making an informed decision that suits your needs and budget.

So remember, when comparing UK train insurance policies, don’t forget to check for any excess charges or hidden costs. It’s an essential step towards finding the right coverage that offers both comprehensive protection and financial peace of mind during your railway journeys.

Consider taking out an annual policy if you travel regularly by train, as this could save you money in the long run.

If you find yourself frequently hopping on trains for your daily commute or regular trips around the UK, it’s worth considering an annual train insurance policy. While it may seem more convenient to purchase a single-trip policy each time you travel, opting for an annual policy can actually save you money in the long term.

An annual train insurance policy provides coverage for multiple trips throughout the year, typically at a fixed premium. This means that whether you’re travelling once a week or several times a month, you’ll be protected without having to worry about purchasing individual policies each time.

By opting for an annual policy, you can often benefit from cost savings compared to buying multiple single-trip policies. Insurance providers understand that frequent travellers are more likely to make claims, so they offer discounted rates for those who choose long-term coverage. This can result in significant savings over time.

Moreover, an annual policy offers convenience and peace of mind. You won’t have to remember to purchase insurance every time you plan a trip or worry about gaps in coverage between policies. With an annual policy in place, you can simply focus on enjoying your journey knowing that you’re protected against unexpected events.

When considering an annual train insurance policy, be sure to review the coverage limits and benefits offered by different insurers. Look for policies that provide comprehensive protection for incidents such as theft or loss of personal belongings, accidents or injuries on trains or at stations, trip cancellations or delays due to unforeseen circumstances and any other specific needs you may have.

It’s important to note that an annual policy may not be suitable for everyone. If your train travel is infrequent or irregular, it may be more cost-effective to opt for single-trip insurance as and when needed. Assess your travel patterns and requirements before making a decision.

At TrainSureQuotes.co.uk, we understand the importance of finding the right insurance coverage for your train journeys. Our comparison platform allows you to easily compare annual policies from multiple insurers, helping you find the best option that saves you money while providing the necessary coverage.

So, if you’re a regular train traveller in the UK, consider taking out an annual policy for your peace of mind and potential cost savings. Start comparing UK train insurance policies today and ensure that you’re adequately protected every time you step on board a train.

If possible, use a comparison website to ensure you get the best deal on your insurance policy.

Getting the Best Deal on UK Train Insurance: The Power of Comparison Websites

When it comes to purchasing insurance for your train journeys in the UK, it’s essential to find the best deal that offers comprehensive coverage at an affordable price. With numerous insurance providers and policies available, the task may seem daunting. However, there is a simple and effective tip that can help you in your quest: use a comparison website.

Comparison websites have revolutionized the way we shop for insurance. They provide a convenient platform where you can compare multiple insurers and their policies side by side, allowing you to make an informed decision based on your specific needs and budget.

Using a comparison website for UK train insurance comparison offers several advantages:

- Time-Saving: Instead of individually researching and contacting various insurance providers, a comparison website brings all the information together in one place. You can easily input your requirements and preferences, then receive a list of relevant policies to compare.

- Comprehensive Coverage: A comparison website allows you to evaluate different policies’ coverage options, ensuring that you choose one that meets your specific needs. You can easily compare features such as personal belonging protection, accident coverage, trip cancellation benefits, and more.

- Cost-Effective: By using a comparison website, you can quickly compare premiums across different insurers. This helps you find competitive rates while still obtaining the level of coverage you require. It ensures that you get the best value for your money.

- User-Friendly Interface: Comparison websites are designed with user experience in mind. They provide an intuitive interface that makes it easy for anyone to navigate through different policies and understand their key features.

- Transparency: Comparison websites present information in a clear and transparent manner, allowing you to make an apples-to-apples comparison between various insurers’ offerings. This transparency helps you make an informed decision based on facts rather than marketing jargon.

When using a comparison website for UK train insurance comparison, it’s important to input accurate and complete information to receive the most relevant results. Take the time to carefully review the policies and consider factors such as excess amounts, additional benefits, and customer reviews before making your final decision.

At TrainSureQuotes.co.uk, we understand the importance of finding the best deal on UK train insurance. Our user-friendly comparison platform allows you to effortlessly compare multiple insurers, ensuring that you get the coverage you need at a price that suits your budget.

So, why settle for a policy that may not provide adequate coverage or cost you more than necessary? Take advantage of comparison websites and unlock the power of choice. Start comparing UK train insurance policies today and secure peace of mind for your railway journeys.