Trainline Cancellation Insurance: Peace of Mind for Your Train Journeys

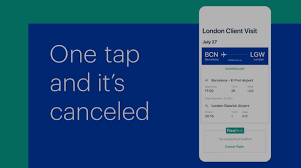

Travelling by train is a convenient and efficient way to get around, but unexpected events can sometimes disrupt your plans. That’s where Trainline Cancellation Insurance comes in to offer you peace of mind and financial protection.

Whether you’re a frequent commuter or an occasional traveller, having cancellation insurance can help you avoid the stress and financial burden of unexpected changes to your travel itinerary. Trainline’s insurance coverage is designed to reimburse you for non-refundable train tickets in case you need to cancel or amend your journey due to unforeseen circumstances.

With Trainline Cancellation Insurance, you can rest assured that you’re covered in situations such as illness, accidents, or other emergencies that may prevent you from travelling as planned. By investing in this insurance, you can protect yourself from losing the cost of your train tickets if your plans change unexpectedly.

Having cancellation insurance through Trainline not only provides financial protection but also gives you the flexibility to make changes to your travel arrangements without worrying about losing money. It’s a small investment that can make a big difference when life throws unexpected curveballs your way.

Don’t let unforeseen circumstances derail your travel plans. Consider opting for Trainline Cancellation Insurance and enjoy peace of mind knowing that you’re covered no matter what happens.

Essential Tips for Choosing Trainline Cancellation Insurance

- Check the policy details to understand what is covered and what isn’t.

- Ensure the insurance covers cancellations due to unforeseen circumstances like illness or strikes.

- Compare different providers for the best coverage and price.

- Purchase cancellation insurance at the same time as booking your tickets for full coverage.

- Keep all relevant documentation such as receipts and medical certificates in case you need to make a claim.

- Know the process for making a claim, including any deadlines for submitting paperwork.

- Look out for exclusions, such as pre-existing medical conditions or specific travel routes not being covered.

- Verify if there is a deductible amount that you would need to pay before the insurance kicks in.

- Review customer reviews and ratings of the insurance provider to ensure reliable service.

Check the policy details to understand what is covered and what isn’t.

When considering Trainline cancellation insurance, it is crucial to thoroughly review the policy details to gain a clear understanding of what is included in the coverage and what is not. By familiarising yourself with the terms and conditions of the insurance policy, you can make informed decisions about your protection and ensure that you are aware of any limitations or exclusions that may apply. Taking the time to check the policy details will help you have a comprehensive grasp of your coverage, allowing you to travel with confidence and peace of mind knowing exactly what scenarios are covered under your insurance plan.

Ensure the insurance covers cancellations due to unforeseen circumstances like illness or strikes.

When considering Trainline Cancellation Insurance, it is crucial to ensure that the policy provides coverage for cancellations arising from unforeseen events such as illness or strikes. By verifying that the insurance includes protection for a wide range of unexpected circumstances, including those beyond your control, you can travel with confidence knowing that you are adequately safeguarded against potential disruptions to your journey.

Compare different providers for the best coverage and price.

When considering Trainline cancellation insurance, it’s advisable to compare offerings from different providers to ensure you get the best coverage and price. By exploring various options, you can find a policy that not only meets your specific needs but also fits within your budget. Comparing providers allows you to make an informed decision and select the most suitable insurance plan for your train journeys, giving you confidence and peace of mind while travelling.

Purchase cancellation insurance at the same time as booking your tickets for full coverage.

For full coverage and peace of mind, it is recommended to purchase Trainline cancellation insurance at the same time as booking your train tickets. By doing so, you ensure that you are protected from unforeseen circumstances right from the start of your journey planning. This proactive approach not only guarantees comprehensive coverage but also allows you to make changes to your travel plans without the worry of incurring additional costs or losing the value of your tickets. Opting for cancellation insurance at the time of booking is a smart decision that can help you navigate any unexpected disruptions with confidence and financial security.

Keep all relevant documentation such as receipts and medical certificates in case you need to make a claim.

It is essential to keep all relevant documentation, including receipts and medical certificates, when considering Trainline Cancellation Insurance. In the event that you need to make a claim due to unforeseen circumstances such as illness or emergencies, having these documents on hand will streamline the claims process and ensure that you receive the reimbursement you are entitled to. By maintaining organised records, you can navigate any potential claim with ease and efficiency, providing peace of mind during unexpected disruptions to your travel plans.

Know the process for making a claim, including any deadlines for submitting paperwork.

When considering Trainline Cancellation Insurance, it is crucial to familiarise yourself with the claims process, including any specific deadlines for submitting required paperwork. Understanding the steps involved in making a claim can help streamline the process and ensure that you receive timely reimbursement in case of unexpected disruptions to your travel plans. By being aware of the necessary procedures and deadlines, you can navigate the claims process effectively and maximise the benefits of your insurance coverage.

Look out for exclusions, such as pre-existing medical conditions or specific travel routes not being covered.

When considering Trainline cancellation insurance, it is crucial to pay attention to potential exclusions that may impact your coverage. Be mindful of exclusions such as pre-existing medical conditions or specific travel routes that may not be covered under the policy. Understanding these limitations upfront can help you make informed decisions and ensure that you have the appropriate level of protection for your train journeys.

Verify if there is a deductible amount that you would need to pay before the insurance kicks in.

When considering Trainline Cancellation Insurance, it’s crucial to verify whether there is a deductible amount that you would need to pay before the insurance coverage takes effect. Understanding any potential deductible can help you make an informed decision about your level of financial protection and ensure that you are fully aware of the terms and conditions of the insurance policy. By clarifying this detail upfront, you can avoid any surprises and confidently rely on the insurance to provide the coverage you need in case of unforeseen circumstances affecting your train journey.

Review customer reviews and ratings of the insurance provider to ensure reliable service.

When considering Trainline cancellation insurance, it is advisable to review customer reviews and ratings of the insurance provider to ensure reliable service. By taking the time to assess feedback from other customers, you can gain valuable insights into the quality of service offered, the efficiency of claims processing, and overall customer satisfaction levels. This information can help you make an informed decision and choose an insurance provider that is known for delivering trustworthy and dependable coverage for your train journeys.