The Importance of Getting an Insurance Quote

Insurance is a crucial part of financial planning and risk management. Whether you’re looking to protect your home, car, health, or travels, having the right insurance coverage can provide peace of mind and financial security in times of need.

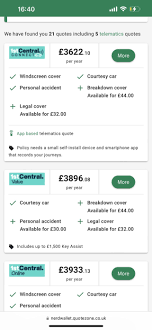

One of the first steps in getting insurance is obtaining an insurance quote. An insurance quote is an estimate of how much you will need to pay for a specific type and level of coverage. It’s important to get multiple quotes from different insurers to compare prices, coverage options, and customer reviews.

Getting an insurance quote allows you to:

- Understand the cost: By getting quotes from different insurers, you can compare prices and choose a policy that fits your budget.

- Evaluate coverage options: Insurance quotes outline what is covered and what is not covered under a policy. This helps you choose the right level of protection for your needs.

- Identify discounts: Insurers often offer discounts for various reasons such as bundling policies, having a good driving record, or installing security devices in your home. Getting quotes can help you identify potential discounts.

- Choose the right insurer: Reading customer reviews and comparing quotes can help you select an insurer with a good reputation for customer service and claims handling.

When getting an insurance quote, be sure to provide accurate information about yourself and your needs to receive the most accurate estimate. Remember that the cheapest quote may not always be the best option if it means sacrificing essential coverage or dealing with poor customer service.

Ultimately, getting an insurance quote is a crucial step in finding the right coverage for your needs. Take the time to compare quotes, understand your options, and choose an insurer that provides reliable protection and peace of mind.

Six Essential Tips for Securing the Best Insurance Quote

- Compare quotes from multiple insurance providers to get the best deal.

- Make sure you provide accurate information to receive an accurate quote.

- Consider the coverage options and not just the price when choosing an insurance policy.

- Check for any available discounts that you may qualify for to lower your premium.

- Review the policy details carefully, including exclusions and limitations, before making a decision.

- Don’t hesitate to ask questions or seek clarification from the insurance provider if needed.

Compare quotes from multiple insurance providers to get the best deal.

To ensure you secure the best insurance deal tailored to your needs, it is essential to compare quotes from multiple insurance providers. By obtaining and reviewing quotes from different insurers, you can evaluate various coverage options, pricing structures, and potential discounts available. This proactive approach not only helps you find a policy that fits your budget but also enables you to make an informed decision based on a comprehensive assessment of the offerings in the market. Comparing quotes from multiple providers empowers you to select the most suitable insurance coverage that provides optimal value and peace of mind.

Make sure you provide accurate information to receive an accurate quote.

To ensure that you receive an accurate insurance quote, it is essential to provide precise and truthful information about yourself and your insurance needs. Inaccurate or incomplete details can result in an estimate that does not reflect your actual risk profile, potentially leading to unexpected costs or coverage gaps. By being transparent and thorough when supplying information to insurers, you can obtain a more precise quote that aligns with your requirements and offers the right level of protection for your specific circumstances.

Consider the coverage options and not just the price when choosing an insurance policy.

When selecting an insurance policy, it is essential to consider the coverage options offered, rather than solely focusing on the price. While cost is a significant factor, ensuring that the policy provides adequate coverage for your specific needs and potential risks is equally important. By carefully evaluating the coverage options available, you can make an informed decision that not only fits your budget but also offers comprehensive protection and peace of mind in times of need. Remember, the true value of an insurance policy lies in its ability to provide sufficient coverage when it matters most.

Check for any available discounts that you may qualify for to lower your premium.

When obtaining an insurance quote, it’s essential to check for any available discounts that you may qualify for in order to lower your premium. Insurers often offer discounts for various reasons, such as bundling policies, having a good driving record, or installing security devices in your home. By taking the time to explore these potential discounts, you can ensure that you are getting the most cost-effective coverage without compromising on essential protection.

Review the policy details carefully, including exclusions and limitations, before making a decision.

It is essential to thoroughly review the policy details, including exclusions and limitations, before finalizing your decision on an insurance quote. Understanding what is covered and what is not covered under the policy can prevent any surprises or misunderstandings in the event of a claim. By taking the time to carefully examine these aspects of the policy, you can ensure that you are selecting the right level of coverage that meets your specific needs and provides you with the protection you require.

Don’t hesitate to ask questions or seek clarification from the insurance provider if needed.

When obtaining an insurance quote, it is essential not to hesitate to ask questions or seek clarification from the insurance provider if needed. Understanding the terms, coverage details, and any exclusions in the policy is crucial to making an informed decision. By seeking clarification, you can ensure that you have a clear understanding of what you are purchasing and avoid any surprises in the event of a claim. A reputable insurance provider will be more than willing to address your concerns and provide you with the information you need to feel confident in your choice of coverage.