Comparing Insurance: Finding the Right Coverage for You

When it comes to choosing insurance, the options can be overwhelming. With so many providers and policies available, how do you know which one is right for you? This is where comparing insurance becomes crucial.

By comparing insurance policies, you can ensure that you find the coverage that best meets your needs and budget. Here are some key points to consider when comparing insurance:

- Coverage: Look closely at what each policy covers. Consider your specific needs and make sure the policy provides adequate protection in areas that are important to you.

- Premiums: Compare premiums from different providers to find a price that fits your budget. Remember that the cheapest option may not always offer the best coverage.

- Deductibles: Check the deductibles for each policy. A higher deductible usually means lower premiums, but make sure you can afford to pay the deductible if you need to make a claim.

- Exclusions: Be aware of any exclusions in the policy. Make sure you understand what is not covered so there are no surprises later on.

- Customer Reviews: Take the time to read reviews from other customers. This can give you insight into how well a provider handles claims and customer service.

Comparing insurance may take some time and effort, but it’s worth it to ensure that you have the right coverage when you need it most. Remember, everyone’s insurance needs are different, so what works for one person may not work for another.

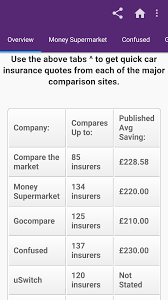

Take advantage of online comparison tools or speak with an insurance broker to help guide you through the process. By comparing insurance options carefully, you can feel confident that you’ve made an informed decision about your coverage.

Whether you’re looking for car insurance, home insurance, travel insurance or any other type of coverage, comparing policies is key to finding peace of mind and financial security in an unpredictable world.

8 Essential Tips for Comparing Insurance Policies in the UK

- 1. Compare quotes from multiple insurance providers to find the best deal.

- 2. Consider the coverage offered by each policy, not just the price.

- 3. Look for any additional benefits or perks included in the insurance policies.

- 4. Check for any exclusions or limitations that may affect your coverage.

- 5. Review customer reviews and ratings to gauge the quality of service provided by each insurer.

- 6. Take note of any deductibles or excess payments required in case of a claim.

- 7. Ask about discounts available, such as multi-policy or no-claims bonuses.

- 8. Make sure you understand all terms and conditions before making a decision.

1. Compare quotes from multiple insurance providers to find the best deal.

When seeking insurance coverage, it is essential to compare quotes from multiple insurance providers to secure the best deal. By obtaining quotes from various insurers, you can evaluate the range of options available and identify the most competitive rates and comprehensive coverage that align with your specific needs. This proactive approach allows you to make an informed decision, ensuring that you not only save money but also receive adequate protection for peace of mind in any unforeseen circumstances.

2. Consider the coverage offered by each policy, not just the price.

When comparing insurance policies, it is essential to consider the coverage offered by each policy, rather than solely focusing on the price. While cost is important, ensuring that the policy provides adequate protection for your specific needs is paramount. By carefully examining the coverage details of each policy, you can make an informed decision that not only fits your budget but also safeguards you against potential risks and uncertainties. Remember, the true value of insurance lies in the protection it offers when you need it most.

3. Look for any additional benefits or perks included in the insurance policies.

When comparing insurance policies, it’s essential to look for any additional benefits or perks that may be included. These extras can vary between providers and could offer added value to your policy. Whether it’s roadside assistance, no-claims bonuses, or coverage for special circumstances, taking note of these additional benefits can help you choose a policy that not only meets your basic needs but also provides extra advantages that may come in handy in the future.

4. Check for any exclusions or limitations that may affect your coverage.

When comparing insurance policies, it is essential to thoroughly review any exclusions or limitations that could impact the extent of your coverage. Understanding what is not covered in a policy is just as important as knowing what is included. By checking for exclusions or limitations upfront, you can avoid potential surprises and ensure that you have the protection you need in situations that matter most.

5. Review customer reviews and ratings to gauge the quality of service provided by each insurer.

When comparing insurance options, it’s essential to review customer reviews and ratings to gauge the quality of service provided by each insurer. By reading feedback from other policyholders, you can gain valuable insights into how well an insurance company handles claims, responds to inquiries, and overall customer satisfaction. Taking the time to consider customer experiences can help you make an informed decision and choose an insurer that not only offers the right coverage but also delivers excellent service when you need it most.

6. Take note of any deductibles or excess payments required in case of a claim.

When comparing insurance policies, it is essential to take note of any deductibles or excess payments that may be required in the event of a claim. Understanding the amount you will need to contribute towards a claim can significantly impact your overall cost and financial planning. Be sure to consider whether you can comfortably afford the deductible and excess payments associated with each policy before making your decision.

7. Ask about discounts available, such as multi-policy or no-claims bonuses.

When comparing insurance options, it’s essential to inquire about available discounts, such as multi-policy discounts or no-claims bonuses. These discounts can help you save money on your premiums while still maintaining comprehensive coverage. By asking about these discounts, you may find opportunities to maximise your savings and get the most value out of your insurance policies.

8. Make sure you understand all terms and conditions before making a decision.

When comparing insurance policies, it is essential to pay close attention to Tip 8: Make sure you understand all terms and conditions before making a decision. Understanding the fine print of an insurance policy is crucial to ensure that you are fully aware of what is covered, what is not covered, any limitations or exclusions, as well as the process for filing claims. By taking the time to carefully review and comprehend all terms and conditions, you can make an informed decision that aligns with your needs and provides you with the peace of mind knowing that you have the right coverage in place.